Energy Investor Services

Zenergy has been developing and investing in renewable energy projects for over 7 years.

Client’s hire us to gain this insider knowledge and structured finance expertise as they pursue a deal.

About Zenergy’s Investor Services

What We Do

Zenergy provides energy investors origination services, due diligence, structured finance advice, and fund formation support.

Who We Are

We bring the expertise of attorneys, investors, developers, and installers to each deal.

Who We Work With

Our clients include institutional investment funds, early stage private equity groups, corporate tax equity investors, traditional banks, and high net worth individuals.

- Raising Tax Equity & Fund Formation 80%

- Diligence & Valuation 45%

- Strcture Analysis & Equity Research 39%

- Sourcing Projects For Funding 72%

Fund Formation & Raising Tax Equity

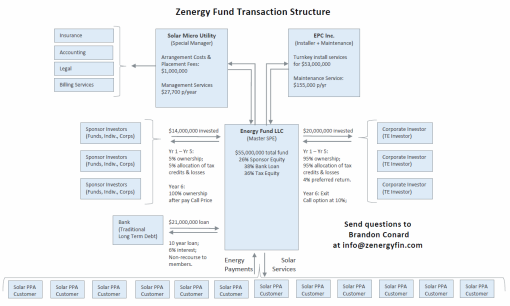

When creating a new energy fund, Zenergy assists in structuring the investments, sourcing tax equity and debt, preparing pro-formas, and advising on the constellation of agreements needed by the fund. We help investors arrange the following capital:

- Tax Equity

- Construction Finance

- Traditional Debt

- Alternative Debt

- Pre-Development Capital

- Sponsor Equity

Working With Us To Raise Your Fund

Fund Strategy & Structure Planning

Our Fund Formation service includes:

a) Advice relating to the structure and design of the FundCo;

b) Its investment objectives and policies;

c) The impact of accounting, tax, and debt aspects on the FundCo; and

d) Assistance with the organization and formation of the FundCo.

Financial Models & Scenario Analysis

Zenergy’s models evaluate the following scenarios:

• Inverted Lease

• Partnership Flip

• Sale Lease Back

• 2 tiers of Debt

• YieldCo Structures

• REIT Structures

Entity & Project Contract Templates

Contract Template Package includes:

- Power Purchase Agreement

- Site Lease

- Engineering, Procurement, & Construction Agreement

- Developer Fee Agreement

- Operations & Maintenance Agreement

- Funding Commitment Letter

- LLC Operating Agreement, and

- Subscription Agreements.

Capital Raise and Development Support

In supporting capital raise efforts, Zenergy will:

– engage tax equity investors and banks

– prepare investment presentation materials

– facilitate the negotiation and close.

Structure Planning & Analysis

Evaluate your projects. Recommend the deal terms needed to optimize your return.

Evaluate Structure

Recommend alternative capital stack structures. Identify challenges with current plan.

Tax Analysis

Many proformas get the tax calculations wrong. Depreciation is overstated. Gains on exit are understated. Section 7701(e) is violated.

Advise on market rates/terms

We can tell you if you are getting a fair deal or paying too much. We see deals everyday from all over the country.

Investment Modeling

We confirm the energy production, operational costs, and financial calculations underlying your valuation.

Project Finance Portfolio Investment Model

Investment grade financial models. Granular operational analysis. Robust scenario options.

Tax Equity Scenarios

- Inverted Lease,

- Partnership Flip

- Sale Lease Back

Granual Project Inputs

Allows unlimited projects, each with its own input assumptions

Public vs Private Equity

Compare benefits of:

- Traditional LLC,

- YieldCo, and

- REIT Structures

Financial Modeling & Scenario Analysis

![]()

The output is a set of recommendations on transaction structure, investment terms, PPA pricing, and other parameters (e.g. EPC price, development fees, IRRs).

Project Origination

Zenergy matches investors with developers offering projects meeting their investment criteria.

Zenergy works with an extensive network of developers in commercial, industrial, and utility sectors. As an owner operator of projects, we understand exactly what makes a successful project and what obstacles to consider in the process.

We leverage that network to source new projects for clients, while also tapping that experience to assist in vetting opportunities.

Learn More About Project Sourcing >>

MW of Project Funding Requests

Developers In Network

States & Island Territories

Project Diligence & Valuation

Transactional Diligence

Transactional Diligence

Review project agreements to find gaps in key terms or inconsistencies with offering summary.

Technical Design Review

Technical Design Review

Evaluate the current design and engineering choices. Run production output models to confirm revenue estimates.

Project Costs Assessment

Project Costs Assessment

Independently confirm project costs offered by the developer are competitive with market rates.

Investment Valuation

Investment Valuation

We model a variety of scenarios to identify the investment’s true valuation and the terms that optimizes your return.